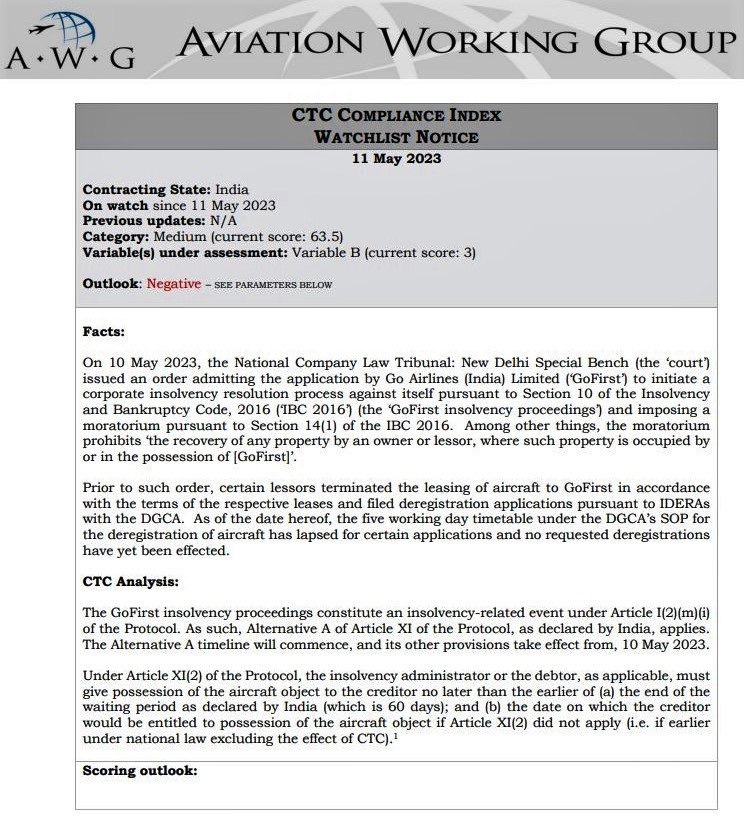

Indian Ultra low -cost carrier "Go First" is facing a deeper crisis as the Aviation Working Group (AWG), a non-profit organization co-chaired by Airbus & Boeing, issued a "watchlist notice" regarding the airline's compliance with the Cape Town Convention (CTC).

The global aviation leasing watchdog, not only put India on a watchlist , it also painted a negative outlook accusing india to have failed to comply with international aircraft repossession norms after airline Go First was granted bankruptcy protection.

Noteworthy is , on May 2 , 2023 , Go First filed for voluntary insolvency resolution proceedings and sought an interim moratorium on financial obligations, simultaneously canceling flights for next two days.

CTC , entered into force in 2006 , is a treaty designed to facilitate asset-based financing and leasing of aviation equipment, expand financing opportunities, and reduce costs – thereby providing substantial economic benefits. For this case, the Cape Town Convention (CTC) enables lessors to get their aircraft back from defaulting or defunct airlines.

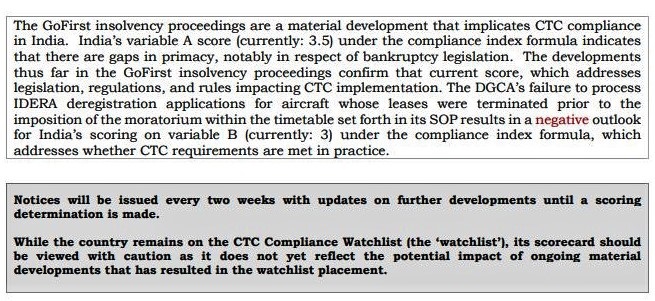

India should be concerned , as the move from the Aviation Working Group (AWG), a UK-based entity that monitors leasing and financing laws on behalf of planemakers and lessors, could raise leasing costs for Indian airlines.

AWG is a not-for-profit entity co-chaired by Airbus and Boeing. Its members include major lessors and financial institutions like Aircastle, BOC Aviation, SMBC Aviation Capital, Deutsche Bank, Goldman Sachs and Morgan Stanley.

Additionally , the development could discourage lessors to engage transactions in the world's third-largest domestic aviation market, that has shown immense promise in the post Pandemic growth.

The inability to repossess Go First's planes in a timely manner comes as Indian air travel is booming and hundreds of new jets have been ordered by local carriers, who regularly turn to lessors to help finance plane purchases.

Go Airlines (India) Ltd filed for bankruptcy protection last week, blaming "faulty" Pratt & Whitney (P&W) engines for the grounding of about half its 54 Airbus A320neos. As per Go First , increasingly unreliable and malfunctioning engines from Pratt & Whitney have forced Go First to ground 28 aircraft , i.e. approximately 50 per cent of its Airbus A320neo fleet , as on first week of May 2023, that made operations unsustainable.

However, the PW1127G Turbofan engine maker P&W , a part of Raytheon Technologies , has maintained that Go First's claims are without evidence.

Other Pratt & Whitney Stories...

Go First (formerly GoAir), had filed an application with the National Company Law Tribunal (NCLT) in Delhi today under section 10 of the Insolvency Bankruptcy Code (IBC) .

And , while granting protection, the Indian tribunal ordered a freeze on Go First's assets even though some lessors had already terminated their leases with the airline and placed requests with the aviation regulator to repossess more than 40 aircraft.

Failure to process deregistration applications for aircraft with leases terminated before the freeze was imposed, "results in a negative outlook", AWG said in its watchlist notice.

Courtesy : Aviation Working Group (AWG)

While the Indian aviation regulator — Directorate General of Civil Aviation (DGCA) had issued a show cause notice to the carrier on May 4, NCLT admitted Go First's petition for insolvency resolution proceedings and imposes a moratorium on the airline on May 9.

Since 2019, GoFirst is the second Indian airline to file for bankruptcy after Jet Airways. While India's aviation growth story heavily depends on fleet expansion through grlobal lessors , carriers like Air India have also struggled to lease aircraft at will.

The negative painting by AWG is under what it calls the compliance index, which addresses whether requirements under the Cape Town Convention, an international treaty on plane repossessions, are met in practice.

Earlier, India made it easier for lessors to take back planes if airlines default on payments after joining the Cape Town Convention in 2008, but bankruptcy protection supersedes repossession requests under its local laws.

"The Go First insolvency proceedings are a material development that implicates Cape Town Convention compliance in India," AWG said.

While, this step will further complicate the leasing transactions in India , Go First's current lessors SMBC Aviation Capital, CDB Aviation's GY Aviation Leasing, Jackson Square Aviation and Bank of China Aviation, will more than be worried to secure their planes or rentals.

Related News....