On Tuesday — 2nd May 2023, the Cash-strapped Indian "Go First" had announced that it's filing for for the voluntary insolvency resolution proceedings, which is similar to the Chapter 11 of the United States Bankruptcy Code , following the cancellation of all its flights on May 3,4 and 5.

However, Go First aircraft lessor, SMBC Aviation Capital was not impressed by the new development with the Lessee, and it moved the National Company Law Appellate Tribunal (NCLAT) on Thursday challenging the National Company Law Tribunal (NCLT)'s order which admitted the GoFirst airlines' insolvency process.

In return, the Indian National Company Law Appellate Tribunal (NCLAT) has decided to hear the plea filed by Go First aircraft lessor, SMBC, on May 12, Friday.

The airline has been maintaining that it was seeking voluntary insolvency due to "serial failure" of Pratt & Whitney engines. The airline was forced to ground more than half of its fleet due to the non-supply of engines by Pratt & Whitney (P&W).

The carrier, which has been in operation for more than 17 years and is owned by the Wadia group, took this step following arbitration proceedings in Singapore and the filing of a lawsuit in a US court to enforce an arbitration award.

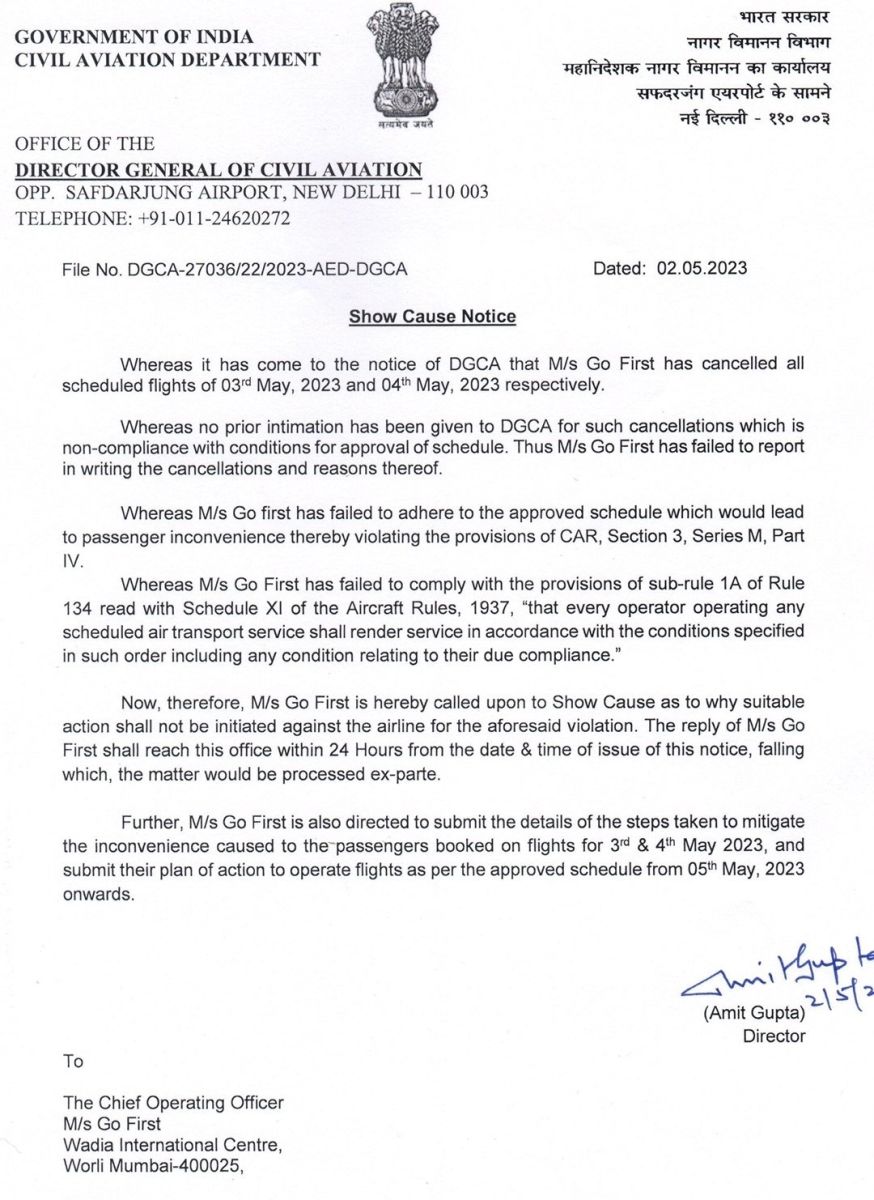

Earlier on Wednesday, the NCLT had admitted Go First's plea for voluntary insolvency and admitted for the initiation of Corporate Insolvency Resolution Process (CIRP) proceedings. NCLT has granted Go First protection under a moratorium from recovery by lessors and lenders , while Civil Aviation Regulator DGCA had issued a show cause notice prior to that.

NCLT, in its order, said, "We admit the plea of Go Airlines for insolvency proceedings. It said that we appoint Abhilash Lal as IRP (insolvency resolution professional)."

"The suspended board of directors will cooperate with the IRP. Suspended directors are also ordered to deposit ₹5 crore to make the immediate expenses," the order stated.

The airline has been grappling with engine issues since January 2020. Go First said that Pratt & Whitney failed to follow an order issued by the Singapore International Arbitration Centre (SIAC) emergency arbitrator to deliver at least 10 leased serviceable spare engines by April 27 and another 10 spare leased engines each month until December 2023. This led to the airline being unable to comply with its financial obligations and hence forced to approach the NCLT.

The Ultra Low Cost carrier had also canceled all the flights' operations till May 19 due to operational reasons, " Go First Flights until 19th May 2023 are canceled. We apologize for the inconvenience caused and request customers."

"We have been obliged to take this action despite the promoters' investment of Rs 3,200 crore in the airline over the last three years, Rs 2,400 crore of which were infused in the last 24 months, Rs 290 crore in April 2023 alone. This takes the total promoter investment in the airline to almost Rs 6,500 crore since its establishment.

"Go First has also received significant assistance from the Government of India's Emergency Credit Line Guarantee Scheme," the airline said, stating that it took all measures to safeguard the interests of its stakeholders.

US-based engine manufacturers Pratt and Whitney has defended itself against the budget airline's claim that P&W is responsible for the financial condition and bankruptcy. P&W earlier also stated that Go First has a long history of missing financial commitments to Pratt & Whitney.