Could be surprise for many , and also aviation industry , but that's how they have done it — Alaska Air Group and Hawaiian Holdings have announced that they have entered into a definitive agreement under which Alaska Airlines will acquire Hawaiian Airlines for $18.00 per share in cash, for a transaction value of approximately $1.9 billion, inclusive of $0.9 billion of Hawaiian Airlines net debt.

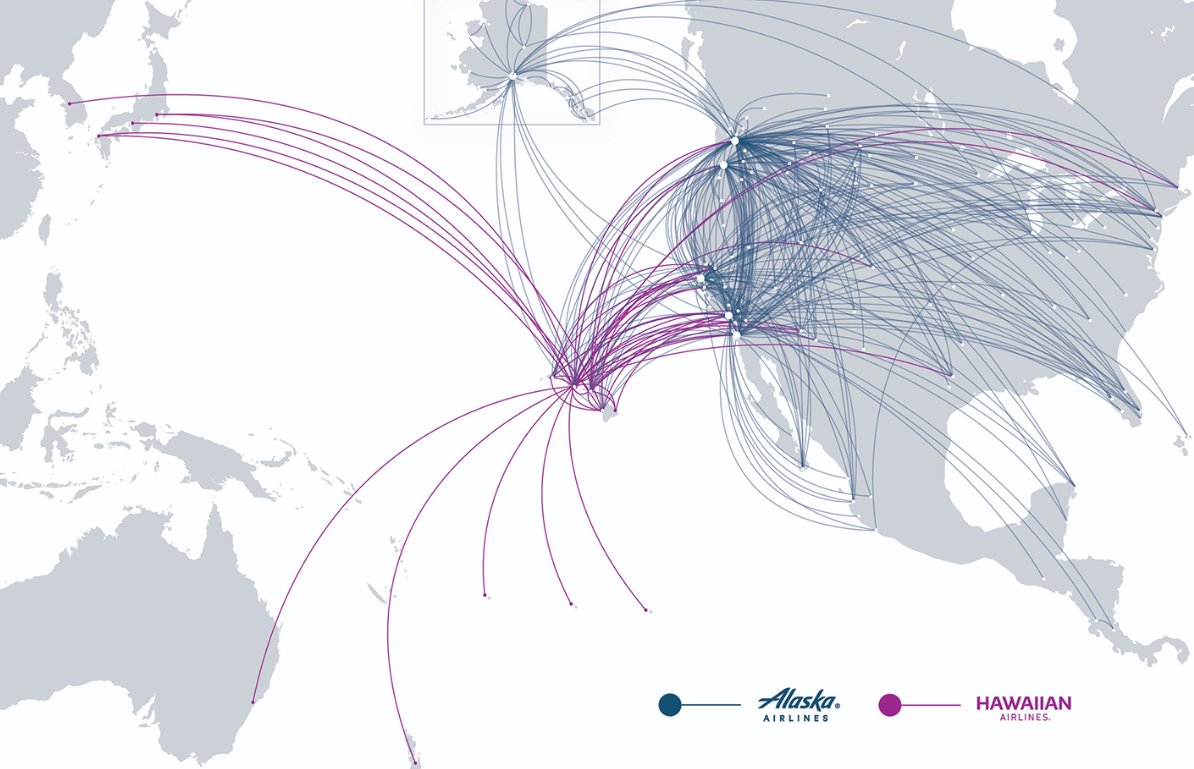

The combined company will unlock more destinations for consumers and expand choice of critical air service options and access throughout the Pacific region, Continental United States and globally.

The transaction is expected to enable a stronger platform for growth and competition in the U.S., as well as long-term job opportunities for employees, continued investment in local communities and environmental stewardship.

As airlines rooted in the 49th and 50th U.S. states, which are uniquely reliant upon air travel, Alaska Airlines and Hawaiian Airlines share a deep commitment to caring for their employees, guests and communities.

This combination will build on the 90+ year legacies and cultures of these two service-oriented airlines, preserve both beloved brands on a single operating platform, and protect and grow union-represented jobs and economic development opportunities in Hawai‘i, with a combined network that will provide more options and added international connectivity for travelers through airline partners including, the oneworld Alliance.

The merger will take up to 18 months and will be headquartered in Seattle under Minicucci’s leadership, but Honolulu will become a key hub for the airline.

Ben Minicucci, Alaska Airlines CEO said,

“This combination is an exciting next step in our collective journey to provide a better travel experience for our guests and expand options for West Coast and Hawai‘i travelers,”

“We have a longstanding and deep respect for Hawaiian Airlines, for their role as a top employer in Hawai‘i, and for how their brand and people carry the warm culture of aloha around the globe. Our two airlines are powered by incredible employees, with 90+ year legacies and values grounded in caring for the special places and people that we serve. "

"I am grateful to the more than 23,000 Alaska Airlines employees who are proud to have served Hawai‘i for over 16 years, and we are fully committed to investing in the communities of Hawai‘i and maintaining robust Neighbor Island service that Hawaiian Airlines travelers have come to expect. We look forward to deepening this stewardship as our airlines come together, while providing unmatched value to customers, employees, communities and owners.”

Peter Ingram, Hawaiian Airlines President and CEO in Alaska Airlines said ,

“Since 1929, Hawaiian Airlines has been an integral part of life in Hawai‘i, and together with Alaska Airlines we will be able to deliver more for our guests, employees and the communities that we serve,”

"we are joining an airline that has long served Hawai‘i, and has a complementary network and a shared culture of service. With the additional scale and resources that this transaction with Alaska Airlines brings, we will be able to accelerate investments in our guest experience and technology, while maintaining the Hawaiian Airlines brand."

"We are also pleased to deliver significant, immediate and compelling value to our shareholders through this all-cash transaction. Together, Hawaiian Airlines and Alaska Airlines can bring our authentic brands of hospitality to more of the world while continuing to serve our valued local communities.”

On the operation of the combined entity , the press release reads , the combination of complementary domestic, international, and cargo networks is positioned to enhance competition and expand choice for consumers on the West Coast and throughout the Hawaiian Islands through:

According to the joint statement, the investment plans to “maintain and grow” union-represented jobs in Hawaii, including keeping pilot, flight attendant and maintenance bases in Honolulu and other airline operations across the islands.

The companies hope the acquisition will provide more opportunities for career advancement, competitive pay and benefits and geographic mobility for employees.

The release says , as an integrated company, Alaska Airlines and Hawaiian Airlines will continue this stewardship and maintain a strong presence and investment in Hawai‘i. The combined company will drive:

The combination fits strategically with Alaska Airlines' sustained focus on expanding options for West Coast travelers and creates an important new platform to further enhance Alaska Airlines' above industry-average organic growth.

The transaction is designed to deliver attractive value creation for Alaska Airlines' shareholders while providing a compelling premium for Hawaiian Airlines shareholders.

The transaction agreement has been approved by both boards. The acquisition is conditioned on required regulatory approvals, approval by Hawaiian Holdings, Inc. shareholders (which is expected to be sought in the first quarter of 2024), and other customary closing conditions.

It is expected to close in 12-18 months. The combined organization will be based in Seattle under the leadership of Alaska Airlines CEO Ben Minicucci. A dedicated leadership team will be established to focus on integration planning.

BofA Securities and PJT Partners are serving as financial advisors and O’Melveny & Myers LLP is serving as legal advisor to Alaska Airlines. Barclays is serving as financial advisor and Wilson Sonsini Goodrich & Rosati, Professional Corporation is serving as legal advisor to Hawaiian Airlines.

Source : Alaska Airlines

Alaska Airlines News....