AviLease, the Ireland-registered aircraft lessor that is owned by the Saudi government, has agreed a deal to buy Standard Chartered’s aviation finance unit – which includes Dublin-based Pembroke Aircraft Leasing, for $3.6 billion.

The aviation business on sale , accounted for about 2 per cent of the London-based bank’s operating income and about 1 per cent of its risk-weighted assets, as per sources. The bank’s operating income was US$14.7 billion in 2021, and its risk-weighted assets stood at US$271 billion.

In January 2023, making the intentions clear on the sale of its Aviation Financing business , Simon Cooper, CEO of commercial and institutional banking and Europe and the Americas at Standard Chartered had said,

“We believe that a new owner can drive the next phase of growth whilst we continue to focus on our commitment to improve shareholder returns and delivering on our 2024 targets.”

About the Buyer , Saudi Arabia aims to develop its aviation sector and business around it , increasing its contribution to non-oil gross domestic product as part of its Vision 2030 economic diversification agenda.

Announcement of Riyadh Air and the big aircraft orders are definite signs of this. This strategy is backed by $100 billion in government and private sector investment.

Standard Chartered Group press release read,

Standard Chartered Group has signed agreements dated 28 August 2023 for the sale of its global aviation finance leasing business (through the sale of shares in relevant subsidiaries and minority equity interests held by the Standard Chartered Group engaged in such business) for an initial total cash consideration of US$0.7 billion (the “Consideration”) to Aircraft Leasing Company (“AviLease”), owned by the Public Investment Fund, Saudi Arabia’s sovereign wealth fund.

AviLease, which was founded in June 2022 and has its headquarters in Riyadh, is part of the PIF’s efforts to boost the kingdom’s aviation sector.

In June, it secured a $1.1 billion five-year loan from a banking syndicate to fund the expansion of its fleet. It plans to expand its fleet to about 300 aircraft by 2030 as it aims to become one of the world's top aircraft leasing companies.

As mentioned above, the announcement follows Standard Chartered’s statement in January 2023 that it intended to explore alternatives for the future ownership of its global aviation finance business. The sale is expected to complete towards the end of 2023.

AviLease chief executive Edward O'Byrne said,

“We are purchasing a very high-quality portfolio of narrow body aircraft on lease to top-tier airlines globally,”

“The transaction accelerates the scale-up and lessee diversification of our fleet, demonstrating our ability to execute on our investment strategy."

As part of the transaction, AviLease arranged $2.1 billion of bridge financing commitments from four banks including BNP Paribas, Citibank, HSBC Bank Middle East and MUFG Bank.

Simon Cooper, Chief Executive Officer of Corporate, Commercial & Institutional Banking and Europe & Americas at Standard Chartered, said:

“The sale of our Aviation Finance leasing business allows us to continue focusing our efforts on those areas where we are most differentiated, and make further progress on our Return on Tangible Equity journey."

"I want to thank our Aviation Finance colleagues, whose commitment to building an outstanding franchise over more than 15 years has enabled the success of this transaction.”

Standard Chartered’s Aviation Finance business is a leading global aircraft leasing and financing operation. It owns and manages a modern fleet portfolio of over 120 aircraft on lease to over 30 of the world’s leading airlines.

In 2022, the aviation leasing business recorded a profit before tax of US$18.2 million, a profit after tax of US$15.6 million, gross assets of US$3.8 billion and a net asset value of US$0.3 billion and in 2021 a profit before tax of US$51.8 million and a profit after tax of US$44.9 million.

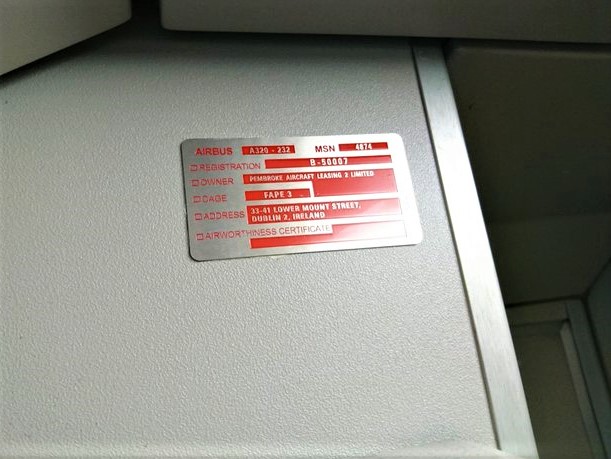

The transaction includes the sale of 100% shareholding in each of Pembroke Group Limited (Isle of Man), Pembroke Aircraft Leasing Holdings Limited (Ireland) and Pembroke Aircraft Leasing (Tianjin) Limited (China).

Upon completion of the sale these companies will no longer be subsidiaries of Standard Chartered. AviLease is also funding the repayment of approximately US$2.9 billion of net intra-group financing from the Standard Chartered Group (the “Intra-group Loan”). The Intra-Group Loan is subject to adjustment with reference to the amount due at completion.

On completion of the transaction Standard Chartered will record an estimated gain of approximately US$0.3 billion and an increase in Common Equity Tier 1 capital ratio by around 19 basis points.

However, the Agreements are subject to customary closing conditions, which remain to be satisfied as at the date of this announcement. Standard Chartered continues to be supported by J.P. Morgan Securities PLC as its financial advisor.