In a major development , on Dec. 18 , L3Harris Technologies and Aerojet Rocketdyne Holdings, Inc. have signed of a definitive agreement for L3Harris to acquire Aerojet Rocketdyne for $58 per share, in an all-cash transaction valued at $4.7 billion, inclusive of net debt.

Going ahead , the acquisition move will face various criticism and will come under the hammer of Regulatory Authorities , as the deal comes to media two years after Lockheed Martin tried to buy the Aerojet in a $4.4 billion offer , but was blocked by antitrust regulators earlier this year.

The previous deal had drawn criticism because it would have given Lockheed Martin , the No. 1 defense contractor , a dominant position over a vital piece of the U.S. missile industry. Rocket motors are used in everything from the homeland defensive missile system to Stinger missiles. Missile maker Raytheon was also very critical of the proposed deal , that failed.

Context of criticism was , Raytheon and Lockheed both build missiles for the U.S. military and American allies, and Aerojet Rocketdyne is a key supplier to both firms. While , Lockheed’s orders account for about 34 percent of Aerojet’s sales in 2020 ; Raytheon’s, touched 17 percent.

Now , Melbourne — Florida based L3Harris is buying Aerojet at $58 per share in an all-cash transaction. Aerojet shares traded at $54.89 on Dec. 16. The deal is expected to close in 2023, pending regulatory approvals.

This marks L3Harris’ second acquisition announcement of 2022, demonstrating its continued focus on delivering critical capabilities to warfighters while strengthening the nation’s defense industrial base through increased competition.

In the month of October this year , L3Harris Technologies had announced to acquire satellite operator Viasat, Inc.’s tactical radio business – Tactical Data Links (TDL) – for approximately $1.96bn.

Vandenberg Air Force Base, Calif. U.S. AIR FORCE / SENIOR AIRMAN AUBREE OWENS

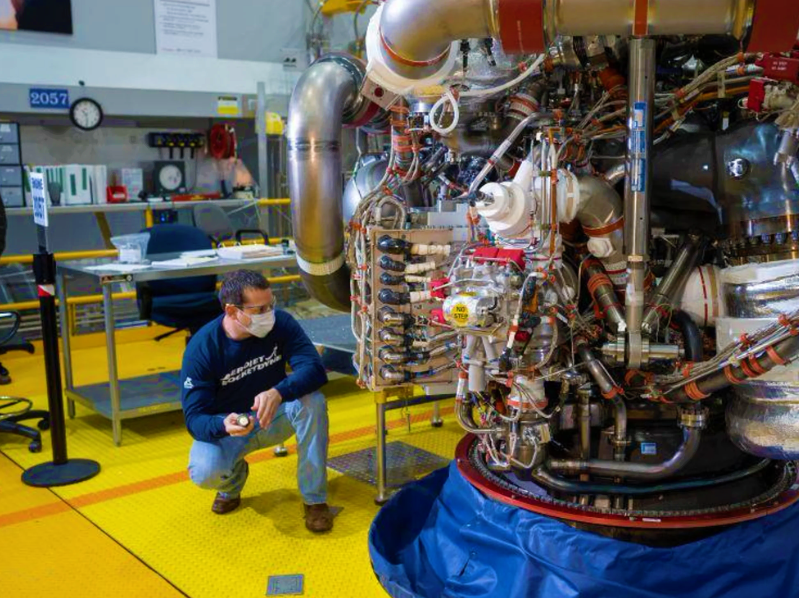

Sacramento based Aerojet Rocketdyne manufactures rocket engines and propulsion systems for space vehicles, military tactical weapons and ballistic missiles with an annual revenue generation of approximately $2.3 billion , while L3Harris touches $17 billion figure in annual revenue.

Aerojet Rocketdyne’s employees operate primarily out of advanced manufacturing facilities in Canoga Park, California; Camden, Arkansas; West Palm Beach and Orlando, Florida; Huntsville, Alabama; Orange, Virginia; Redmond, Washington; Stennis Space Center, Mississippi; Jonesborough, Tennessee; and Carlstadt, New Jersey.

Courtesy : Aerojet Rocketdyne

As L3Harris looks to expand through targeted investment in advanced missile technologies and hypersonics , experts believe , the acquisition of Aerojet would give L3Harris a greater footprint in civil space, strategic defense systems and precision munitions.

“We’ve heard the DoD leadership loud and clear: they want high-quality, innovative and cost-effective solutions to meet both current and emerging threats, and they’re relying upon a strong, competitive industrial base to deliver those solutions,” said Christopher E. Kubasik, L3Harris CEO and Chair.

“With this acquisition, we will use the combined talents of more than 50,000 employees to drive continuous process improvement, enhance business operations and elevate the performance of this crucial national asset.”

As an independent U.S. supplier of propulsion systems for tactical missiles, Aerojet for the past two years has been under limelight over the consolidation of aerospace and defense industry firms, while multiple buyers interested in acquiring Aerojet included General Electric, Textron and other private equity firms.

Aerojet’s CEO Eileen Drake said,

“This agreement will accelerate innovation for national security propulsion solutions while providing a premium cash value for our shareholders and tremendous benefits for our employees, customers, partners and the communities in which we operate, "

“Joining L3Harris is a testament to the world-class organization and team we’ve built and represents a natural next phase of our evolution. As part of L3Harris, we will bring our advanced technologies together with their substantial expertise and resources to accelerate our shared purpose: enabling the defense of our nation and space exploration."

"This is an exciting new chapter for Aerojet Rocketdyne and our over 5,200 dedicated team members, providing them with additional opportunities, and we look forward to working closely with L3Harris to complete this transaction.”

As Aerojet executives believe in the need of more financial resources to invest in next-generation technologies, the proposed cash acquisition from L3Harris will be funded with existing cash and the issuance of new debt. The deal is expected to close in 2023, subject to required regulatory approvals and clearances and other customary closing conditions.

On the acquisition and challenges ahead , understandably and based on previous experience in Lockheed case, the Pentagon would support the Federal Trade Commission and Justice in antitrust investigations , and also recommendations involving the defense industrial base.