On 30th March, Air New Zealand had released an Offer Document in connection with a fully underwritten (excluding the Crown Participation) 2 for 1 pro rata renounceable rights offer of New Shares, followed by a shortfall bookbuild process (the Offer).

It's time for the bookbuild process now , as Air New Zealand prepares to sell approximately 274 million shares which were either not taken up by eligible shareholders under the two for one rights offer or were those which related to ineligible shareholders.

Seeing it as a success , the national carrier says about 88 per cent of the new shares - NZ$1.045 billion were taken up by eligible shareholders , against an aim of NZ$1.2 billion from the offer.

Air New Zealand chair Dame Therese Walsh said the airline was ''very pleased'' with the level of take-up.

At this moment , applications were received for a further $71 million in oversubscriptions from existing shareholders applying for more shares than their allocation.

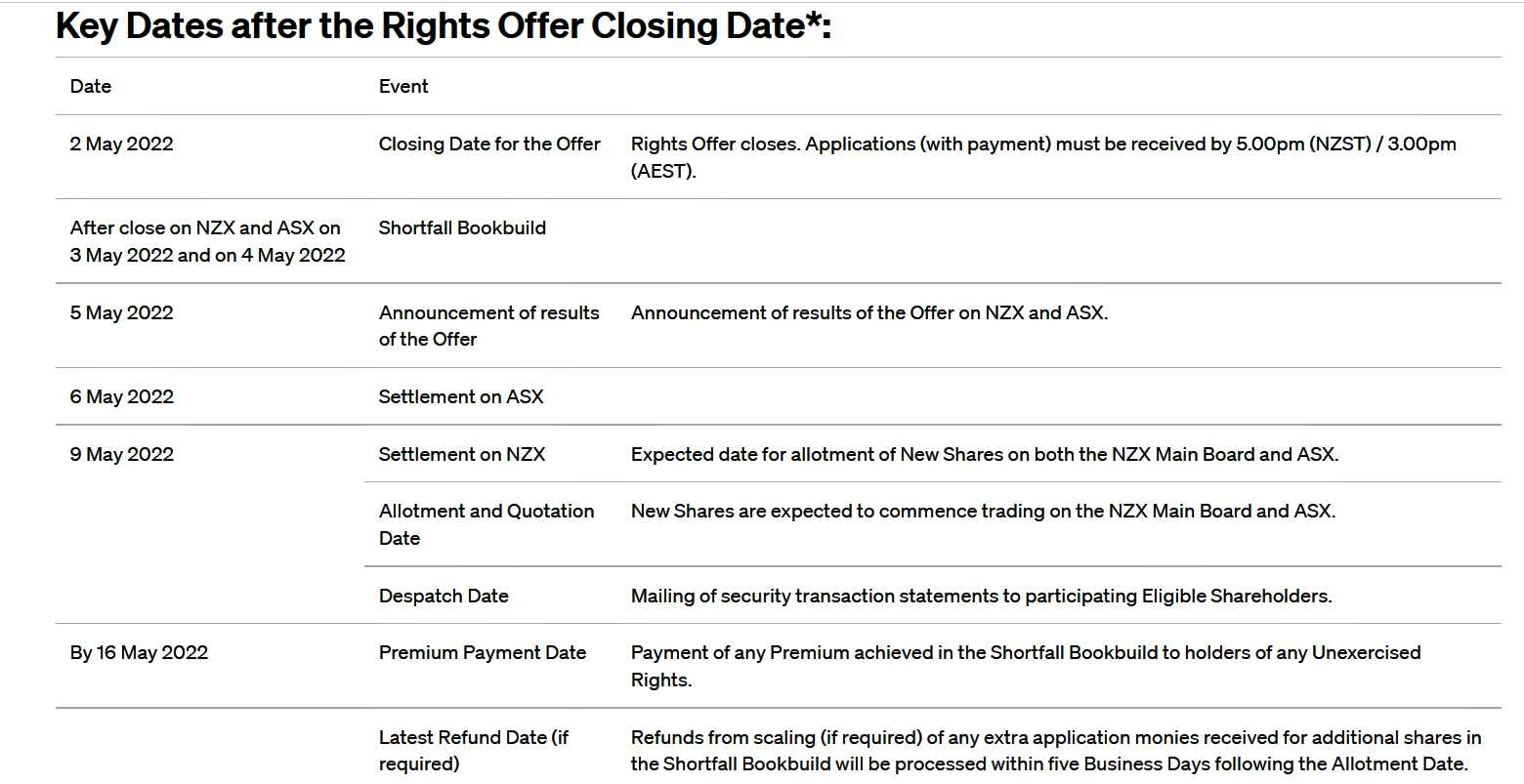

On 27th April 2022, Air New Zealand had sent a reminder to it's eligible shareholders,

Air New Zealand would like to remind Eligible Shareholders that its 2 for 1 pro rata renounceable rights offer ("Rights Offer”) closes at 5.00pm (NZST) / 3.00pm (AEST) on Monday, 2 May 2022.

Bookbuild is like an auction amongst the large brokers and institutional investors, and any premium over the $0.53 rights price will be returned to those who originally owned the rights.

Eligible Shareholders who take up their Rights in full have the opportunity to apply for Additional New Shares in the Shortfall Bookbuild process, which will also involve Institutional Investors.

Any Additional New Shares applied for under the Shortfall Bookbuild will be issued at the Bookbuild Price. The Bookbuild Price will be equal to or above the Offer Price.

There is no limit to the Bookbuild Price. Eligible Shareholders may also participate in the Shortfall Bookbuild through NZX Firms who have been invited to participate in the Shortfall Bookbuild.

The rights offer is part of a $2.2b capital rescue plan and the Government is also providing a $400m backstop loan as part of the $1b in debt that will now be raised.

Air New Zealand chief executive Greg Foran said the airline continues to see encouraging signs in recent passenger booking activity on short haul and international services as a result of New Zealand's border reopening to Australia and visa waiver countries.

The government has bought $602m in shares to maintain it's stake , i.e. subscribed for such number of New Shares so that it will hold 51.00% of the Shares on issue upon completion of the Offer (the Crown Participation).

The Crown’s holding in Air New Zealand will eventually reduce from 51.91% to 51.00% as a result of the Offer.

"We're very pleased with the level of take-up. We thank our shareholders for their support so far, including the Crown which will maintain a majority shareholding,'' Walsh said.

The airline has applied for a trading halt which will start before the market opens today while the bookbuild process takes place.